Imperial School of Banking and Management Studies (ISBMS), Pune

Empowering Future Leaders in Banking, Finance & Business Management

About ISBMS

Imperial School of Banking and Management Studies (ISBMS) stands as a premier institution in Pune, dedicated to shaping future leaders in business management and the Banking, Financial Services, and Insurance (BFSI) sectors. Our commitment to academic excellence, industry-oriented curriculum, and holistic student development sets us apart from other finance colleges in Pune.

Programs Offered

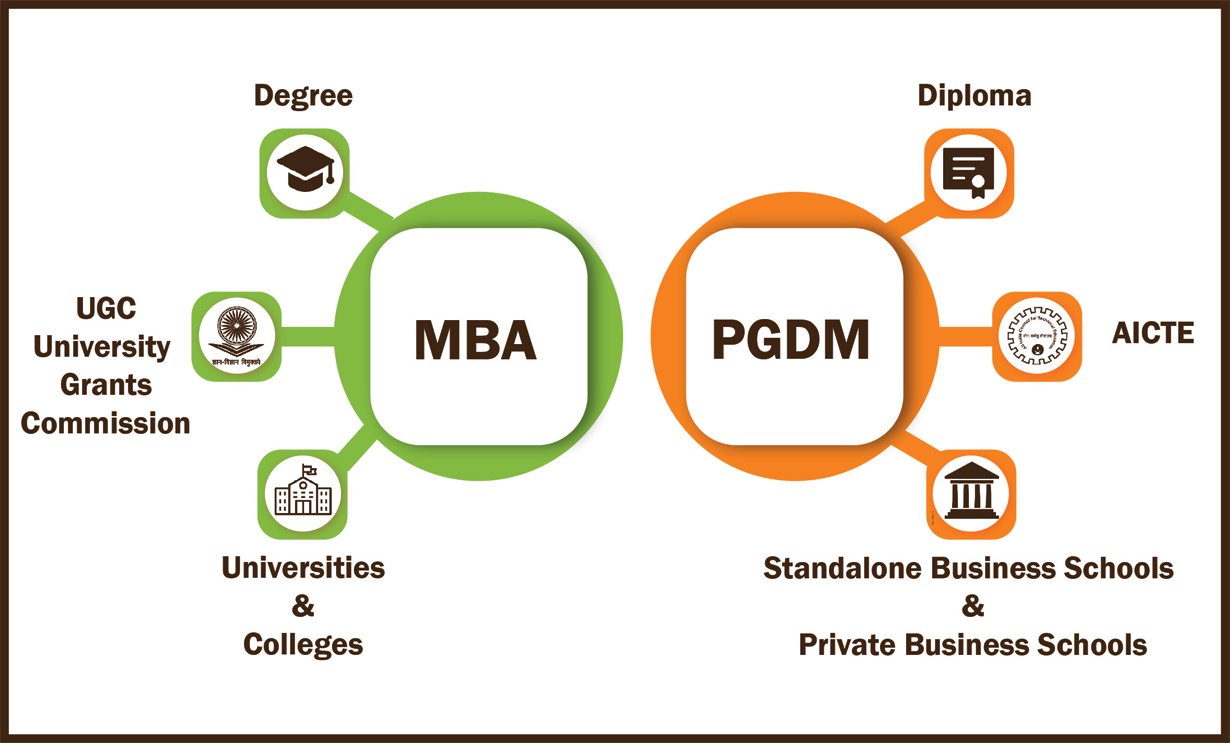

- Post Graduate Diploma in Management (PGDM) – Specializations in Finance, Marketing, HR, and Operations.

- PGDM in Banking & Financial Services (BFSI) – Tailored for students aiming to excel in the finance sector.

- Executive PGDM – For working professionals seeking leadership roles.

Our PGDM programs are AICTE-approved, placing us among the top PGDM colleges in Pune.

Minimum Eligibility Criteria

Applicants must have a bachelor’s degree with a minimum eligibility of 50% aggregate marks from a recognized university.

Entrance Exams Accepted:

We accept scores from leading national management entrance exams:

- CAT (Common Admission Test)

- XAT (Xavier Aptitude Test)

- MAT (Management Aptitude Test)

- CMAT (Common Management Admission Test)

- ATMA (AIMS Test for Management Admissions)

- MAH MBA CET (Maharashtra MBA Common Entrance Test)

This ensures that students from diverse academic backgrounds have a fair opportunity to join ISBMS.

Why Choose ISBMS?

- Specialized Focus on BFSI: Our curriculum bridges the gap between theory and practice, preparing students for careers in banking, insurance, and investment.

- Industry-Relevant Training: Partnerships with top corporations provide students with live projects, internships, and networking opportunities.

- Strong Placement Record: 100% placement assistance with top recruiters in the BFSI sector and beyond.

- Modern Campus & Expert Faculty: A dynamic learning environment supported by experienced industry professionals.

Admissions Open – Apply Now!

Embark on your journey toward a successful career in business management and finance. Apply to one of the leading finance colleges in Pune today and become a part of ISBMS’s legacy of excellence.

For more information about programs, fees, and the application process, contact our admissions team or visit our website.

In the dynamic educational landscape of Pune, the Imperial School of Banking and Management Studies (ISBMS) has established itself as a premier institution dedicated to nurturing professionals in the banking and financial sectors. Since its inception in 2017, has been committed to bridging the gap between academia and industry by offering specialized programs tailored to the evolving demands of the financial services industry.

The Imperial School of Banking and Management Studies (ISBMS Pune), Pune, is a beacon for aspiring professionals aiming to enter the Banking, Financial Services, and Insurance (BFSI) sectors. Established in 2017, ISBMS was founded to bridge the gap between academic education and the practical requirements of industries. With its unwavering commitment to excellence, the institution has quickly risen to prominence in the field of specialized education.

The Beginning of ISBMS Pune

The story of Imperial School of Banking and Management Studies begins with a vision shared by a group of seasoned professionals from the BFSI industry. Recognizing the need for a platform to nurture future-ready professionals, they set out to establish an institute that combined academic rigor with industry relevance. Their mission was simple yet powerful: to create a learning environment that equips students with skills, knowledge, and a forward-thinking mindset essential for navigating the complexities of the financial sector.

The Founders’ Vision

The founders of Imperial School of Banking and Management Studies were not just educators but also leaders from the BFSI industry. Their collective experiences shaped the foundation of this prestigious institution. Here are some key aspects of their vision:

- Bridging the Gap: They sought to connect traditional education with real-world applications, ensuring graduates could seamlessly integrate into professional roles.

- Holistic Development: Emphasis was placed on creating a balanced curriculum that combined technical expertise with soft skills.

- Industry Readiness: By aligning academic programs with market trends, they aimed to produce candidates who are not only knowledgeable but also job-ready.

- Ethical Leadership: The founders believed in instilling a strong sense of ethics and responsibility, preparing students to lead with integrity.

Why Was Imperial School of Banking and Management Studies Started?

The establishment of Imperial School of Banking and Management Studies was driven by several crucial factors that highlighted the need for such an institution:

| Challenge Identified | How ISBMS Addressed It |

|---|---|

| Lack of industry-aligned education | Introduced industry-oriented curricula and advanced programs tailored to BFSI sectors. |

| Shortage of skilled manpower in BFSI sectors | Offered specialized training in banking, finance, and management. |

| Gaps in practical knowledge among graduates | Ensured hands-on learning through case studies, internships, and expert-led sessions. |

| Growing demand for financial sector professionals | Focused exclusively on developing talent for BFSI and management roles. |

The institute’s foundation rested on addressing these gaps and preparing a workforce that could meet industry standards.

The Mission and Vision of Imperial School of Banking and Management Studies

Mission Statement

The mission of Imperial School of Banking and Management Studies is to provide world-class education and practical exposure, ensuring students are equipped to excel in their professional journeys. Their approach revolves around:

- Excellence in Education: Ensuring students receive high-quality academic instruction.

- Industry Collaboration: Partnering with businesses to offer real-world insights and experiences.

- Personal Growth: Encouraging holistic development through extracurricular activities.

Vision

The vision of Imperial School of Banking and Management Studies is to become a leading institution known for its contribution to the BFSI industry. By staying ahead of trends and continuously innovating, the institute aspires to create a lasting impact in the field of management education.

Core Values That Define Imperial School of Banking and Management Studies

- Innovation in Learning: Constantly evolving teaching methods to keep pace with industry changes.

- Integrity: Emphasizing ethical practices in every aspect of education.

- Inclusivity: Creating an environment where every student feels valued and empowered.

- Excellence: Striving for superior outcomes in academics and industry placements.

These values serve as guiding principles for the institution’s endeavors.

Unique Features of Imperial School of Banking and Management Studies

Focus on BFSI Sector

Unlike generic management institutes, ISBMS exclusively caters to the needs of the Banking, Financial Services, and Insurance sectors, making it a niche player in the education ecosystem.

Practical Learning

The institute employs case studies, simulations, and internships to provide hands-on experience. This practical approach ensures students understand real-world challenges and develop problem-solving skills.

Expert-Led Programs

Courses at ISBMS are designed and taught by industry experts with years of experience. Their insights help bridge the gap between theory and practice.

How Imperial School of Banking and Management Studies Stands Out

| Feature | Why It’s Important |

|---|---|

| Industry-Specific Curriculum | Prepares students for BFSI roles with specialized knowledge. |

| AICTE and DTE Recognition | Ensures academic programs meet high-quality standards. |

| Modern Infrastructure | Provides students with state-of-the-art facilities for an enhanced learning experience. |

| Student-Centric Approach | Focuses on the holistic development of every individual. |

Why Choose Imperial School of Banking and Management Studies?

If you’re wondering why Imperial School of Banking and Management Studies is a top choice for aspiring professionals, here’s why:

- Tailored Education for BFSI Sectors: Unlike other management institutes, ISBMS focuses exclusively on the financial services industry.

- Strong Industry Network: The founders’ connections with leading firms ensure students have access to valuable opportunities.

- Commitment to Excellence: The institute’s dedication to maintaining high academic standards is evident in every aspect of its operations.

A Timeline of Imperial School of Banking and Management Studies

Here’s a snapshot of key milestones in the history of ISBMS:

| Year | Milestone |

|---|---|

| 2017 | ISBMS was established in Pune by BFSI professionals. |

| 2018 | Introduced advanced learning methods, including simulations and real-world case studies. |

| 2019 | Partnered with leading financial institutions to offer internship opportunities. |

| 2020 | Recognized for excellence by educational authorities such as AICTE and DTE. |

| 2022 | Expanded facilities to include cutting-edge technology and modern classrooms. |

Key Facts About Imperial School of Banking and Management Studies

- Founded: 2017

- Location: Pune, Maharashtra

- Primary Focus: Banking, Financial Services, and Insurance sectors

- Recognition: Approved by AICTE and DTE

- Founders: A group of seasoned BFSI professionals

What is the cutoff of Imperial School of Banking and Management Studies ?

For taking admission in Imperial College of Engineering in the course of MBA, students have to clear ATMA, GMAT or GRI exam. Eligibility criteria for both the exam needs batchelors or equivalent degree. Cutoff of GMAT was mainly 600+ score and GRI minimun score of 156 in verbal and 158 in quantitative section.

About Imperial School of Banking and Management Studies

Founded by a consortium of seasoned professionals, aims to address the growing need for skilled manpower in the Banking, Financial Services, and Insurance (BFSI) sectors. The institution is recognized by the Directorate of Technical Education (DTE) and approved by the All India Council for Technical Education (AICTE), ensuring adherence to high academic standards.

Imperial School of Banking and Management Studies Courses Offered

ISBMS offers a comprehensive Post Graduate Diploma in Management (PGDM) with specializations in:

- Financial Management

- Marketing Management

These two-year full-time programs are meticulously designed to provide students with in-depth knowledge and practical skills pertinent to their chosen fields.

Imperial School of Banking and Management Studies Fees and Courses Detail

| Program | Specialization | Duration | Eligibility | Total Fees |

|---|---|---|---|---|

| PGDM | Financial Management | 2 Years | Graduation with minimum 50% marks | ₹8.08 Lakhs |

Note: Admission is based on scores from entrance exams such as CAT, XAT, MAT, ATMA, CMAT, or MAH-MBA CET, followed by a personal interview.

At Institute, the flagship offering is the Post Graduate Diploma in Management (PGDM). With its focus on industry relevance and practical learning, this program caters to the unique requirements of the BFSI sector.

Post Graduate Diploma in Management (PGDM)

Duration: 2 years (full-time)

Specializations:

- Financial Management

- Marketing Management

Eligibility:

- Graduate degree in any discipline with at least 50% marks.

- Qualifying scores in competitive exams like CAT, MAT, CMAT, XAT, ATMA, or MAH-CET.

- Final selection involves a personal interview to assess aptitude and career goals.

Specializations in PGDM

1. Financial Management

This specialization focuses on developing advanced skills in investment strategies, financial planning, risk management, and corporate finance.

Core Modules:

- Financial Statement Analysis

- Investment Banking

- Risk Management

- Corporate Taxation

- Financial Modelling

2. Marketing Management

The marketing specialization helps students master branding, digital marketing, and consumer behavior.

Core Modules:

- Marketing Analytics

- Strategic Brand Management

- Sales and Distribution Management

- Consumer Behavior

- Digital Marketing Strategies

Course Structure of PGDM

The two-year PGDM program is divided into four semesters, each covering critical aspects of management education.

| Semester | Core Modules | Specialized Modules |

|---|---|---|

| 1 | Business Economics, Marketing Management, Business Law | Investment Management, Indian Financial Markets, Financial Statement Analysis |

| 2 | Human Resource Management, Financial Management, Business Statistics | Financial Risk Management, Python for Finance, Fund Accounting by KPMG |

| 3 | Strategic Management, Research Methodology, Advanced Excel & Power BI | Security Analysis, Portfolio Management, Artificial Intelligence in Finance |

| 4 | Business Ethics, Corporate Governance, Leadership Skills, Geopolitics | Regulatory Frameworks in Finance, Microfinance, Rural Banking |

Other Courses Offered

In addition to its flagship PGDM, ISBMS also offers Post Graduate Programs (PGP) in specialized areas designed to meet niche industry requirements.

Post Graduate Program in Business Analytics

This 11-month course focuses on advanced analytics, data handling, and predictive modeling, preparing students to tackle complex business challenges.

| Program Features | Details |

|---|---|

| Core Subjects | Predictive Analytics, Data Visualization, Machine Learning, Big Data |

| Tools Covered | Excel, Tableau, Python, R |

| Eligibility | Bachelor’s degree; interest in data and analytics |

Post Graduate Program in Financial Services with CFP Certification

This course prepares students for roles in wealth management, investment advisory, and financial planning, with a focus on certification as a Certified Financial Planner (CFP).

| Program Features | Details |

|---|---|

| Core Subjects | Wealth Management, Risk Planning, Investment Advisory |

| Industry Certification | Prepares students for CFP Certification |

| Eligibility | Bachelor’s degree in any discipline |

Value-Added Certifications at ISBMS

ISBMS integrates multiple certifications into its programs to enhance students’ employability and technical skills.

| Certification | Focus Area | Industry Relevance |

|---|---|---|

| Chartered Institute for Securities & Investment (CISI) | Financial Services, Securities | Globally recognized for BFSI expertise |

| National Institute of Securities Markets (NISM) | Securities Markets Regulation | Adds regulatory and compliance skills to students’ profiles |

| KPMG Certification | Taxation, Financial Auditing | Offers practical knowledge in tax and auditing |

| Advanced Excel, Power BI, Python | Data Analysis, Financial Modelling | Equips students with essential technical skills |

Hands-On Learning Approach

ISBMS places a strong emphasis on experiential learning. The programs are designed to integrate real-world applications, ensuring students are job-ready.

| Learning Methodology | Key Features |

|---|---|

| Internships | Students work with leading BFSI companies to gain practical exposure. |

| Case Studies | Focus on analyzing and solving real-world business problems. |

| Live Projects | Opportunity to apply theoretical knowledge to real-world projects. |

How ISBMS Prepares Students for BFSI Careers

Industry-Aligned Curriculum

ISBMS collaborates with leading industry professionals to ensure its courses remain relevant. The programs focus on both technical expertise and soft skills.

Soft Skills Training

In addition to technical skills, ISBMS focuses on communication, leadership, and critical thinking, which are essential for BFSI roles.

| Skill | Relevance in BFSI |

|---|---|

| Communication | Builds rapport with clients and stakeholders. |

| Leadership | Prepares students for managerial roles. |

| Problem-Solving | Essential for handling complex financial scenarios. |

Why Choose ISBMS Courses?

- Niche Focus on BFSI:

ISBMS exclusively tailors its programs for BFSI sectors, ensuring graduates have specialized knowledge. - Practical Learning Environment:

The integration of internships, live projects, and case studies ensures students are industry-ready. - Global Recognition:

Certifications such as CISI and CFP add significant value to students’ profiles, making them highly employable.

A Glimpse Into the ISBMS Course Advantages

| Feature | Benefits |

|---|---|

| Cutting-Edge Curriculum | Aligns academic programs with the latest industry requirements. |

| Industry Experts as Faculty | Provides students with insights from BFSI leaders and practitioners. |

| Modern Infrastructure | State-of-the-art labs and classrooms facilitate effective learning. |

| Flexible Specializations | Enables students to focus on their areas of interest. |

The Journey of Transformation Through ISBMS Courses

By choosing ISBMS, students undergo a comprehensive transformation, becoming industry-ready professionals equipped with technical expertise, analytical skills, and ethical leadership qualities.

What Makes ISBMS Unique?

- Specialization in BFSI: Students graduate with a deep understanding of finance, banking, and insurance.

- Certifications Embedded in Curriculum: Students acquire multiple certifications without additional effort.

- Networking Opportunities: The institute connects students with industry leaders and alumni for mentorship.

Advanced Programs

To enhance employability and provide specialized training, ISBMS integrates advanced programs into its curriculum:

- Advanced Program in Banking and Finance

- Advanced Program in Marketing

These programs cover various domains of the industry and are designed and delivered by industry professionals, ensuring that students receive practical insights and hands-on experience.

What are the Courses offered in Imperial School of Banking ?

Imperial School of Banking and Management Studies (ISBMS) in Pune offers the following PGDM courses:

PGDM – Financial Management: A two-year course that integrates financial principles with banking and finance training. The course covers topics such as risk analysis, investment banking, and financial management.

PGDM – Marketing Management: A course offered by ISBMS

What are other programs offered by Imperial College of Banking ?

It also offers PGP courses, including: Business Analytics, Financial Services + CFP, and Business Analytics with 3AI.

It is a center for management education (CME) of the All India Management Association (AIMA). The courses are open to graduates from any discipline.

Imperial School of Banking and Management Studies Faculty

The strength of Imperial School of Banking and Management Studies lies in its distinguished faculty, comprising experienced academicians and industry veterans who bring a wealth of knowledge and practical insights to the classroom. Their mentorship plays a pivotal role in shaping the careers of aspiring professionals.

How is the faculty in Imperial School of Banking and Management Studies ?

Teachers at ISBMS are committed to providing quality education. The curriculum at ISBMS is designed to align with industry requirements. It is not very difficult for the students to pass the semester exams under the guidance of experienced faculty.

State-of-the-Art Infrastructure

Imperial School of Banking and Management Studies boasts a modern campus equipped with:

- Smart Classrooms: Facilitating interactive learning experiences.

- High-Tech Laboratories: Providing hands-on training with the latest tools and technologies.

- Resource-Rich Library: Offering access to a vast collection of books, journals, and digital resources.

- Recreational Facilities: Ensuring a balanced and enriching campus life.

Imperial School of Banking and Management Studies Placement

The dedicated placement cell at Imperial School of Banking and Management Studies works tirelessly to connect students with leading organizations in the BFSI sector. The institute has an impressive placement record, with top recruiters including:

- Credit Suisse

- Wells Fargo

- Blackstone

- Crisil

- Morgan Stanley

Imperial School of Banking and Management Studies Placement Highlights:

| Year | Highest Package (INR) | Average Package (INR) |

|---|---|---|

| 2023 | 16 LPA | 9.84 LPA |

Note: The institute also give a 500% return on investment,underscoring the value of education

ISBMS boasts a solid placement record that showcases its effectiveness in preparing students for the competitive BFSI industry. Here are some important placement statistics to note:

| Placement Metric | Details |

|---|---|

| Highest Salary Offered | ₹16 Lakhs per annum (LPA) |

| Average Salary Offered | ₹9.48 Lakhs per annum (LPA) |

| Lowest Salary Offered | ₹6.78 Lakhs per annum (LPA) |

| Top Recruiters | Leading BFSI companies and others across sectors |

These figures reflect the quality of education and the industry relevance of the courses offered at Imperial School of Banking and Management Studies.

Leading Recruiters at ISBMS

The placement cell at ISBMS works tirelessly to connect students with top recruiters. The institute is trusted by a variety of national and international companies that actively seek graduates with a solid background in banking, finance, and management. Here is a list of some of the most prominent recruiters:

| Industry | Top Recruiters |

|---|---|

| Banking & Finance | HDFC Bank, Yes Bank, IDFC First Bank, Axis Bank, BNY Mellon, ICICI Bank |

| Insurance | ICICI Lombard, HDFC Life, Max Life Insurance, Bajaj Allianz |

| Consulting | KPMG, CRISIL, McKinsey & Co., Accenture |

| Technology & E-commerce | Amazon, UpGrad, IndiaMART, Flipkart |

| FMCG | Nestlé, ITC, Shoppers Stop, Asian Paints |

These top recruiters have consistently hired graduates from ISBMS, attesting to the high-quality training and industry readiness of the students.

ISBMS Placement Process

The placement process at ISBMS is designed to be seamless and comprehensive. It includes several stages to prepare students for the competitive job market, from pre-placement training to final recruitment drives.

Pre-Placement Activities

Before the placement season begins, ISBMS organizes a series of activities to ensure that students are well-prepared:

| Activity | Description |

|---|---|

| Industry-Academic Interactions | Guest lectures and seminars from BFSI industry professionals |

| Mock Interviews | Simulated interviews to prepare for real-time interviews |

| Group Discussions | Focus on developing communication and teamwork skills |

| Resume Building Workshops | One-on-one sessions to enhance CVs and LinkedIn profiles |

| Aptitude & Technical Training | Focus on improving technical and analytical problem-solving skills |

These activities help students boost their confidence and gain valuable insights into the expectations of potential employers.

Internship Opportunities

An important part of the placement process is the summer internship program, which typically lasts 6-8 weeks. ISBMS collaborates with various prestigious organizations to provide students with hands-on experience. Internships are an essential component of the curriculum and give students a chance to apply their knowledge in real-world scenarios.

| Company | Internship Role |

|---|---|

| HDFC Bank | Financial Analyst Intern |

| ICICI Lombard | Risk Management Intern |

| CRISIL | Research Intern |

| Redwood | Marketing Intern |

| Axis Bank | Relationship Manager Intern |

These internships not only enhance students’ industry knowledge but also significantly improve their chances of securing full-time roles with top companies.

Final Placement Process

The final placement process is conducted through campus recruitment drives. During this period, companies visit ISBMS to hire students for various roles across different domains. Students are selected based on interviews, aptitude tests, and group discussions, and the roles offered usually span across areas like finance, marketing, operations, and consulting.

The placement cell coordinates with recruiters to ensure a smooth placement process for both students and companies. The final placements offer students a chance to begin their careers in reputable organizations and start their journey toward success.

Placement Support at ISBMS

The placement support system at ISBMS goes beyond just job placement. It is a continuous effort to ensure that every student is well-equipped for a career in the BFSI industry. The institute’s placement cell provides the following services:

| Service | Details |

|---|---|

| Career Counseling | Guidance on career options, interview preparation, and skill enhancement |

| Alumni Network Support | Interaction with alumni for guidance and mentorship |

| Job Alerts | Constant updates on job openings and campus recruitment events |

| Industry Connections | Frequent networking events with industry leaders to provide students with real-world perspectives |

| Personality Development | Soft skills training including communication, leadership, and teamwork skills |

This holistic approach ensures that students have the right tools and resources to succeed in their careers.

Why ISBMS Placements Stand Out

The Imperial School of Banking and Management Studies stands out for its industry-relevant curriculum and strong placement record. The institute’s partnership with top organizations across various sectors ensures that its graduates are not only employable but also well-equipped to excel in their careers.

- Industry-Linked Curriculum: The curriculum is regularly updated in consultation with industry experts to reflect the latest trends and expectations.

- Strong Alumni Network: Graduates of ISBMS are part of a supportive alumni network that plays a crucial role in guiding current students toward professional success.

- Wide Range of Roles: The diversity of recruiters and roles offered during placement drives ensures that students have access to various career paths in banking, finance, marketing, and management.

- High Placement Record: Institute consistently maintains a high placement rate, with many students securing roles in top-tier organizations with attractive salary packages.

Placement Achievements and Statistics

- Placements (2023): Over 90% of students placed in top-tier companies.

- Average Salary: ₹9.48 LPA, with an increasing trend in salary packages.

- Diverse Roles: Students are placed across various departments like finance, operations, analytics, and marketing.

- Global Opportunities: Some students have secured positions with international organizations, reflecting the global recognition of ISBMS.

What is the placement scenario in Imperial School of Banking and Management studies ?

100% placement assistance, 100% internship assistance with finance sector companies like Morgan Stanley, Wipro Blackstone, Mercedes Benz, Asian Paints, and so on. Top roles are analyst, sales officer, MDP Associate, etc. Talking about the package, the highest package is 10 LPA, and the average package is 6.5 LPA.

What are the highest and average package in ISBMS ?

The highest and average package offered to PGDM students during Imperial School of Banking placements in 2024 stood at INR 16.4 LPA and INR 10 LPA, respectively.

Imperial School of Banking and Management Studies Admission Process

Prospective candidates must have a graduate degree with a minimum of 50% aggregate marks. The selection process includes:

- Entrance Exam: Acceptable scores from CAT, XAT, MAT, ATMA, CMAT, or MAH-MBA CET.

- Personal Interview: Conducted by the institute to assess candidates’ suitability.

Application Steps:

- Fill out the online application form.

- Upload necessary documents.

- Pay the application fee.

- Schedule and attend the personal interview.

What is the admission process in ISBMS ?

You need to give the entrance exam and based on your score the next procedure is your interview. The academic committee of the college conduct interview of selected students afterwards you need to pay an initial fee which is the seat booking fee, which is included in your total fees.

Imperial School of Banking and Management Studies Scholarships and Financial Aid

Imperial School of Banking and Management Studies Placement is committed to making quality education accessible. The institute offers scholarships to meritorious and financially needy students, ensuring that financial constraints do not hinder academic aspirations.

Imperial School of Banking and Management Studies Student Life

Beyond academics, Imperial School of Banking and Management Studies Placement fosters holistic development through various clubs and activities:

- Finance Club: Engages students in activities related to financial markets and investment strategies.

- Marketing Club: Focuses on enhancing marketing skills through workshops and real-world projects.

- Cultural Events: Encourages participation in festivals and events, promoting a vibrant campus life.

Imperial School of Banking and Management Studies Alumni Network

ISBMS takes pride in its strong alumni network, with graduates excelling in various sectors of the BFSI industry. The alumni association actively engages in mentoring current students and providing networking opportunities.

Imperial School of Banking and Management Studies Conclusion

The Imperial School of Banking and Management Studies in Pune stands as a beacon for aspiring professionals in the banking and financial sectors. With its industry-aligned curriculum, experienced faculty, and robust placement support, ISBMS is dedicated to shaping the future leaders of the financial world.

Imperial School of Banking and Management Studies FAQs

What are the eligibility criteria for the PGDM program at ISBMS?

Candidates must have a graduate degree with a minimum of 50% aggregate marks and valid scores from entrance exams like CAT, XAT, MAT, ATMA, CMAT, or MAH-MBA CET.

Does ISBMS offer placement assistance?

Yes, ISBMS has a dedicated placement cell that facilitates placements with top organizations in the BFSI sector.

Are there scholarship opportunities available at ISBMS?

Yes, ISBMS offers scholarships to meritorious and financially needy students to ensure accessible quality education.

What specializations are available in the PGDM program at ISBMS?

ISBMS offers specializations in Financial Management and Marketing Management.

How can I apply for the PGDM program at ISBMS?

Interested candidates can apply online through the website by filling out the application form, uploading necessary documents, paying the application fee, and attending the personal interview.